Customers get the chance of purchasing a product or service which they might not have enough money to purchase at the time.

What Are the Benefits of Buy Now, Pay Later?īoth customers and merchants see benefits from resorting to BNPL. The fee can usually vary between 2% and 8% but the main takeway is that fintechs will pocket the differential between what was paid and what was recovered throughout the BNPL established timeframe + fee. The fintech which is providing the BNPL service will act as a lender, meaning that at the time of the transaction, the merchant is compensated by them.īy taking on the responsibility of acting as a payment processor and simultaneously being the lender, fintechs which provide BNPL are willing to accept the risk of non-repayment.īy doing so, fintechs will charge merchants a fee as means of compensation for the underlying risk. How Do Fintechs Make Money with BNPL Transactions? BNPL might begin to make its appearance on credit reports, however, at least initially, it won’t be factored in. Will Buy Now, Pay Later Affect My Credit Score?Īs of right now, no. How Can I Know If I Am Eligible for Buy Now, Pay Later?Īpproval is deliberated usually after a soft credit check, meaning that providers are likely to check the user’s credit score before actually committing. One may be met with other restrictions which can vary on account of the BNPL provider's terms, on how much capital the individual is trying to access on his or her credit score, and on the nature of what the user is trying to buy (as some types of goods might be restricted from purchase).

#Does paypal pay later affect credit score full

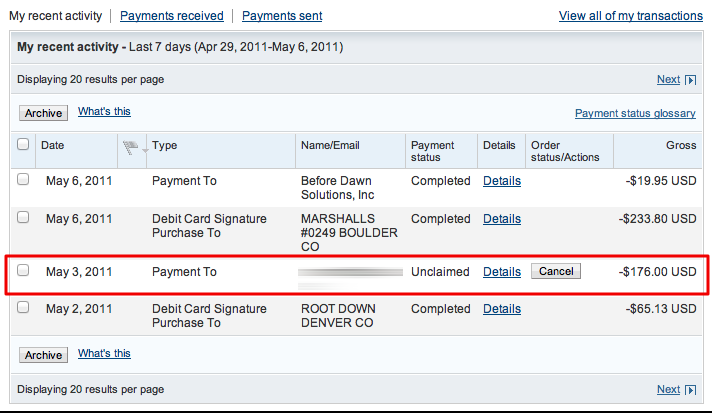

Naturally, the individual using the Buy Now, Pay Later method must have full disclosure of how much he or she will be paying, and when and how often it will happen. It might also be possible to resort to debit and credit cards to repay them. They can be paid via bank transfer or debited from a savings account. Whichever remaining balance is left must be later repaid in interest-free payments with a set payback time frame.

Occasionally, some companies will still operate BNPL with zero down payments from the client. In general terms, the BNPL might require a down payment which is a fraction of the purchase price. How Does Buy Now, Pay Later Work?įirst and foremost, terms of service will vary depending on which fintech is operating the BNPL loan.

This is one of the many reasons we now see banks and fintechs partner up.īNPL’s seamless onboarding is key in the process but its lack of scrutiny when compared to a credit card still leaves many on the back foot. In fact, banks saw the opportunity of using BNPL as an entry point for clients who were reluctant to use a credit card. Banks were apprehensive at first but quickly came to notice how BNPL and credit cards can be complementary to one another.

0 kommentar(er)

0 kommentar(er)